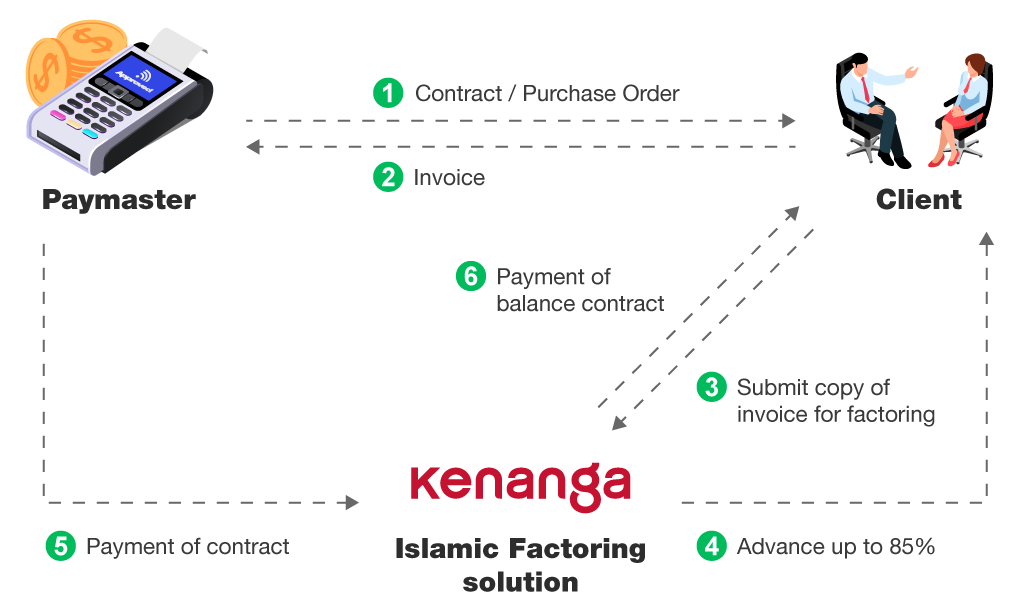

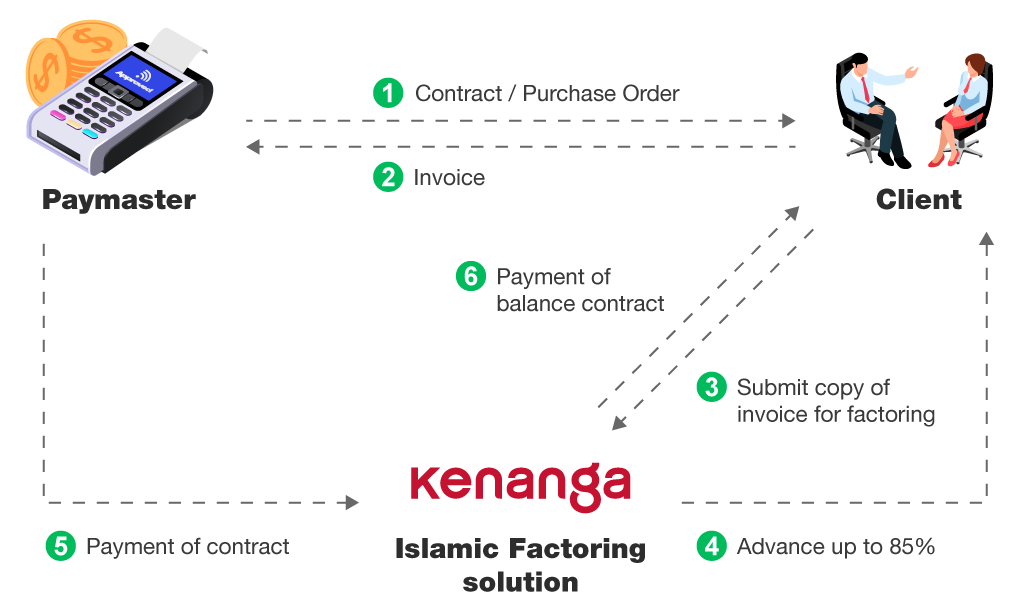

How Kenanga Islamic Factoring solution helps your business get cash advance

How Kenanga Islamic Factoring solution helps your business get cash advance

Key Highlights

Fast loan approval and disbursement

Margin of advance of up to 90% of the contract / purchase order value

Affordable legal and processing fee with low profit rate

Personalised services

No collateral required

‘Riba’ or usury free transactions

Eligibility Criteria

Registered business in Malaysia

Has a contract or purchase order, letter of intent or letter of award

Goods/services offered by the business are Shariah compliant

Eligibility Criteria

Registered business in Malaysia

Has a contract or purchase order, letter of intent or letter of award

Goods/services offered by the business are Shariah compliant

Ready to apply? Here’s what you need to prepare.

- A copy of the identity card of the proprietor/partners/company directors/major shareholders and guarantors

- Statutory Secretarial Forms (only for Berhad and Sdn Bhd)

- Form D (only for sole proprietorship and partnership)

- Audited Business accounts / management accounts

- Copy of your Company’s Bank statements of at least 6 months

- A complete profile of the company / business

- Registration with the Ministry of Finance, Contractor Services Centre (PKK) etc.

- A list of contract, supply or service works completed, in progress or being planned.

- A copy of the contract or work/purchase order to be factored

Interested to know more? Make an appointment with our Financing Specialist today!

Interested to know more? Make an appointment with our Financing Specialist today!

About Us

Established in April 2013 as Kenanga Capital Islamic, is a subsidiary of Kenanga Investment Bank Berhad and has an extensive experience in islamic trade financing. KCi is registered with the Ministry of Finance Malaysia to finance government contracts and orders for companies which supply to the government, government agencies and government owned companies. KCi is also a scheduled institution endorsed by Bank Negara Malaysia, a member of Bursa Suq al-Sila’, Bursa Malaysia and the Malaysian Factoring Association, as well as a registered as a user of the Malaysian government’s e-procurement official portal system, E-perolehan since 2013.

In 2020, KCi has partnered with CapBay (Bay Group Holdings Sdn Bhd). CapBay is an award-winning Multi-Bank Supply Chain Finance and Peer-to-Peer Financing platform that helps SMEs grow and unlock cashflow trapped in their supply chain by providing financing solutions. Through our proprietary credit-decisioning model, businesses of all sizes can obtain short-term financing while banks and investors can participate in high-quality financing deals. Regulated by Securities Commission Malaysia .

PDPA Notice

Kenanga Capital Islamic Helpline:

03 – 2172 3190 / 03 – 2172 3195

Kenanga Investment Bank Berhad General Line:

03 – 2172 2888

Support Email:

[email protected]

Kenanga Capital Islamic Sdn Bhd 201101010778 (938908-X). All rights reserved.

About Us

Established in April 2013 as Kenanga Capital Islamic, is a subsidiary of Kenanga Investment Bank Berhad and has an extensive experience in islamic trade financing. KCi is registered with the Ministry of Finance Malaysia to finance government contracts and orders for companies which supply to the government, government agencies and government owned companies. KCi is also a scheduled institution endorsed by Bank Negara Malaysia, a member of Bursa Suq al-Sila’, Bursa Malaysia and the Malaysian Factoring Association, as well as a registered as a user of the Malaysian government’s e-procurement official portal system, E-perolehan since 2013.

In 2020, KCi has partnered with CapBay (Bay Group Holdings Sdn Bhd). CapBay is an award-winning Multi-Bank Supply Chain Finance and Peer-to-Peer Financing platform that helps SMEs grow and unlock cashflow trapped in their supply chain by providing financing solutions. Through our proprietary credit-decisioning model, businesses of all sizes can obtain short-term financing while banks and investors can participate in high-quality financing deals. Regulated by Securities Commission Malaysia .

PDPA Notice

Kenanga Capital Islamic Helpline:

03 – 2172 3190 / 03 – 2172 3195

Kenanga Investment Bank Berhad General Line:

03 – 2172 2888

Support Email: [email protected]

Kenanga Capital Islamic Sdn Bhd 201101010778 (938908-X). All rights reserved.